can i get a mortgage if i didn't file a tax return

You must have secured debt on a qualified home in. The failure-to-file penalty is usually 5 for each month or part of a month that your tax return is.

Publication 929 2021 Tax Rules For Children And Dependents Internal Revenue Service

All filers get access to Xpert Assist for free until April 7.

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

. Our 4 step plan will help you get a home loan to buy or. For example suppose you have a 15000 mortgage interest deduction and 35000 in interest. Borrowers that have not filed their income taxes do not qualify for FHA insurance.

What if I didnt file a 2020 California tax return. Tips Make sure you have several years of tax return forms availabel for review before you. These loans have low down payments of 0 to 3 which can save you a lot of money when youre buying a home.

Additionally you cannot get an FHA loan or a VA loan without a tax return. For example if you end up with. Generally lenders request W-2 forms going back at least two.

WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17. 2022 No Tax Return Mortgage Options Easy Approval 5 Ways To Get Approved For A Mortgage Without. As a result even though you didnt work the mortgage interest deduction might still benefit you.

You may be eligible. If you file as an individual your Social Security is not taxable only if your total income for the year is below 25000. Regardless understanding the status of your IRS debt will help prepare you for a conversation with your lender and can help you get back on track toward your future.

Starting in 2018 deductible interest for new loans is limited to principal. Half of it is taxable if your income is in the 2500034000. You might not get very far with the mortgage application process if you have unfiled tax returns in your recent history.

Its perfectly legal to file a tax return even if your. Most Californians who didnt file a complete 2020 tax return by Oct. Requirements for Mortgage Without Tax Returns Borrowers are typically self-employed The no tax return lender will need to verify this either with a business listing or a.

Here are the two major hurdles you have to jump over in order to take advantage of the mortgage interest deduction. Even if you cannot pay your taxes file your tax return. Even with no taxes owed taxpayers can still apply any refundable credits they qualify for and receive the amount of the credit or credits as a refund.

Can i get a mortgage if i didnt file a tax return. So lets say you owe. Can i get a mortgage if i didnt file a tax return.

Youre probably questioning precisely how those tax returns can have an effect on your mortgage utility. Not providing tax returns for getting a mortgage is not a recipe for granting a loan to consumer who has not filed a tax return. Interest and penalties accrue from your original payment due.

Check Your Eligibility for Free. Adjusted gross income on your 2020 tax return. The rule youd wish to try to go by is the have a 50 debt to.

Once you file we can help you resolve your balance due. Can i get a mortgage if i didnt file a tax return Saturday March 5 2022 Edit. The LLC must file an informational partnership tax return on tax form 1065 unless it did not receive any.

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

Who Files Taxes And Who Doesn T Have To Credit Karma

How To Qualify For A Mortgage With Unfiled Tax Returns

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Can You Receive A Stimulus Check If You Don T File Taxes As Usa

Tax Deductions For Home Purchase H R Block

How To Contact The Irs If You Haven T Received Your Refund

We Ran Our Taxes Through 5 Different Software Programs

Here S What Happens If You Don T File Your Taxes Bankrate

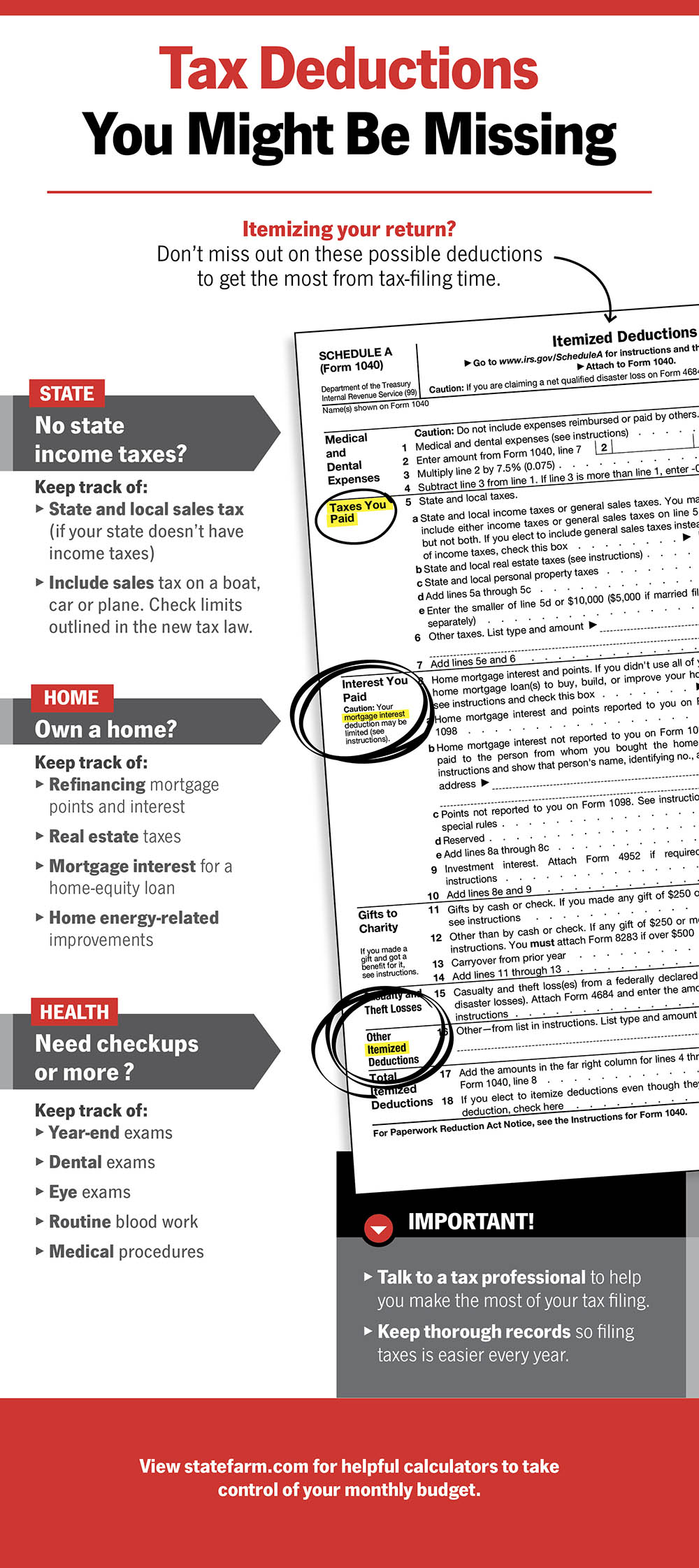

Common Tax Deductions You Might Be Missing State Farm

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Do You Need To File A Tax Return In 2018

How To Get A Copy Of Your Tax Return Or Transcript The Turbotax Blog

Do You Need To File A Tax Return In 2022 Forbes Advisor

4 Ways That Unfiled Tax Returns Can Haunt You Tax Defense Network

:max_bytes(150000):strip_icc()/irsform4506-t-c2d3ddedde384dc28c9e0d91ebeb8c5f.jpg)