is colorado a community property state for tax purposes

Forty-two states and many localities in the United States impose an income tax on individuals. Colorado ˌ k ɒ l ə ˈ r æ d oʊ-ˈ r ɑː d oʊ other variants is a state in the Mountain West subregion of the Western United StatesIt encompasses most of the Southern Rocky Mountains as well as the northeastern portion of the Colorado Plateau and the western edge of the Great PlainsColorado is the eighth most extensive and 21st most populous US.

Community Property States List Vs Common Law Taxes Definition

This is an exemption of the first 50 of the first 200000 in actual value of their.

. Drivers License - New or Renew. Colorado Medical program info -Non medical use info. A corporation trust or community chest fund or foundation.

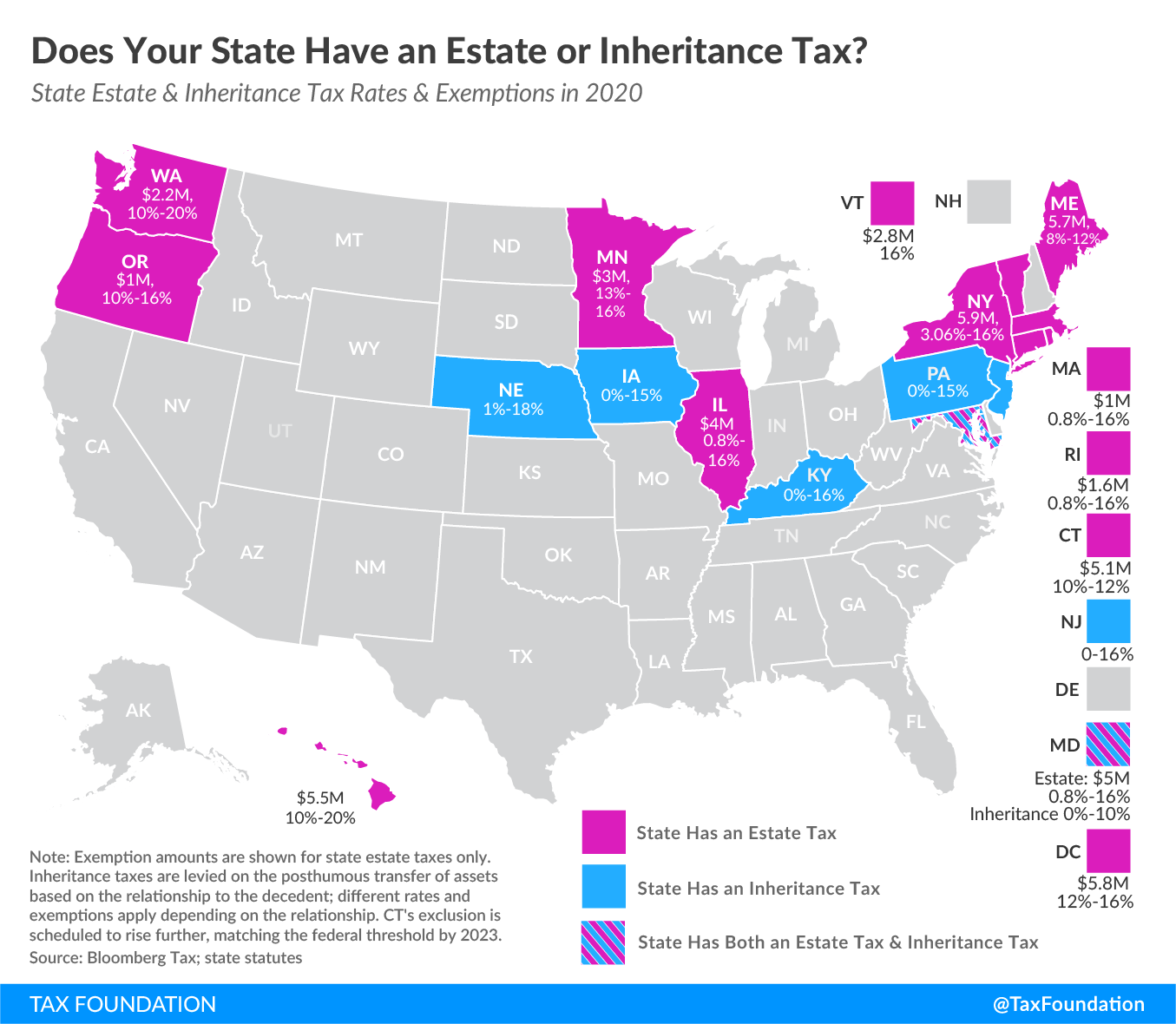

IJ litigates in state and federal courts around the country on behalf of our most fundamental rights including private property economic liberty free speech and educational choice. Order status placement and cancellation. For purposes of the tax imposed by section 2101 the value of the taxable estate of every decedent nonresident not a citizen of the United States shall be determined by deducting from the value of that part of his gross estate which at the time of his death is situated in the.

Wine so produced shall not be subject to any excise tax imposed by this chapter. The First Amendment Amendment I to the United States Constitution prevents the government from making laws that regulate an establishment of religion or that prohibit the free exercise of religion or abridge the freedom of speech the freedom of the press the freedom of assembly or the right to petition the government for redress of grievances. The state tax rate the assessment ratio the portion of the property value subject to tax and the property value.

Amendment 64 2012 Task Force Implementation Recommendations 2013 Analysis of CO Amendment 64 2013 Colorado Marijuana Sales and Tax Reports 2014 Edibles regulation measure FAQ about CO cannabis laws by the Denver Post. The residents of three states stand above the rest experiencing the highest state-local tax burdens in the country. RamCash is a declining-balance account used to buy food beverages and services on campus in the Lory Student Center residential dining facilities Canvas Stadium and more.

In community property states for example the code can step up the tax basis of such property to fair market value. Income tax purposes and required to file annual federal partnership returns of income will not be subject to the Colorado withholding tax. When taxpayers make a certified contribution they can claim.

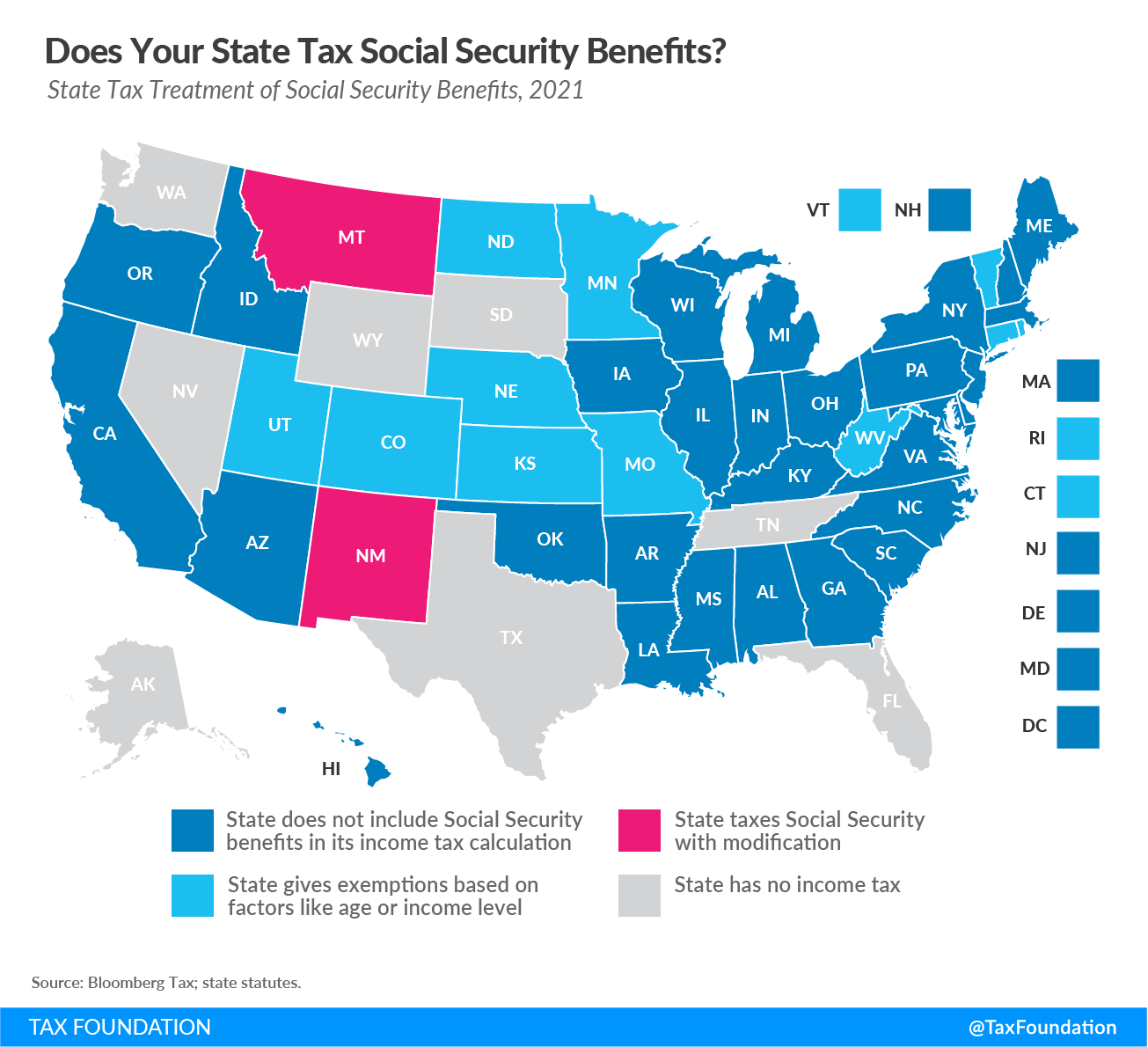

States collect a state income tax. Vehicle Registration - New Stickers. In addition to federal income tax collected by the United States most individual US.

Paying My Property Tax. This exception will not apply to joint ownerships of property which are not recognized as partnerships for federal income tax purposes. Property tax exemptions allow businesses and homeowners to exclude the added value of a solar system from the valuation of their property for taxation purposes.

Vehicle Registration - New Vehicle. Landowners in the United States who donate a qualifying conservation easement to a qualified land protection organization under the regulations set forth in 170h of the Internal Revenue Code may be eligible for a federal income tax deduction equal to the value of their donation. Senate seat in blue Colorado Democrats tried some risky and illegal tricks during a Republican primary and the trickery is being blamed on a senator from New York.

However it can offer substantial tax benefits for couples who own real estate and stay married in the event of the death of the first spouse. Because property taxes are collected locally some. The Enterprise Zone Contribution Tax Credit provides a tax credit to Colorado taxpayers that contribute to targeted enterprise zone EZ projects.

B For purposes of this Code section a single individual who is not a dependent of another person for purposes of Georgia income taxation shall be considered a head of a household. Some local governments also impose an income tax often based on state income tax calculations. Instructions and FAQs Annual Reports for Exempt Property Schools Charitable 2022 FraternalVeterans Organizations 2022 Religious Purposes 2021 Religious Purposes 2022 Exempt Property Report Online Filing.

The value of the easement donation as determined by a qualified appraiser. Search for Kitsap County property tax statements building permits sales history and assessments by tax account number address or by going directly to parcel map. Politics-Govt CO senate primary unveils dirty Dems desperate ruse.

Eight states impose no state income tax and a ninth New. 125 of an in-kind donation as a state income tax credit. Amendment 20 2000 Yes.

An exemption makes it more economically feasible for a taxpayer to install a solar system on a residential or commercial property. To qualify for a commission in WA you must either be a resident or have a place of business in that state. New York 159 percent of state income Connecticut 154 percent and Hawaii 141 percent.

To qualify for an AZ Notary commission you must either be a resident of Arizona state for income tax purposes and claim your Arizona residence as the primary residence on state and federal tax returns or be registered to vote in Arizona. Some of these values fluctuate according to the market and state. Are you a high school student who wants to help lead our community.

Assessors find annual property tax liability by multiplying three values. Assessor Kitsap County Assessor 614 Division St MS-22 Port Orchard WA 98366 Phone. In the race for a safe US.

Colorado Disabled Veteran Property Tax Exemption. Assessment is based on a unit called a mill equal to one-thousandth of a dollar. It was adopted on December 15.

The Exemptions Section is responsible for determining qualification for exemption from property taxation for properties that are owned and used for religious charitable and private school purposes. A property tax hike to support roughly 32 million in funding for the Denver Public Library will be on the ballot this November after the City Council voted Monday to send the question to voters. Currently exempt property owners are required to file annual reports with the DPT in order to continue exemption.

About a purchase you have made. University Housing residents with an on-campus meal plan receive a 150 RamCash allowance each semester. Learn more about Colorado Property Tax Deferral for Seniors and Active Military Personnel.

Consider attending the 2022 Youth Congress where you will connect. Michigan veterans with 100 disability status are eligible to receive full disabled veteran property tax exemption. 25 of a cash donation as a state income tax credit.

Not specified in state statute see federal law. The nations only libertarian civil liberties public interest law firm. By contrast the median state-local tax burden is 102 percent and the national average is 116 percent.

A property tax exemption is available to 100 disabled Veterans and Surviving Spouses of 100 disabled Veterans. Account holders can log into MyRamCardcolostateedu to add funds to their. Veterans with 100 disability status are eligible to receive a 300000 devaluation in their homes assessed value for property tax purposes and those with 70 and above are eligible to receive 150000 devaluation.

The community property system can impose tax consequences in the event of divorce. The sale of property jointly owned by a husband and wife for example.

Tax Burden By State 2022 State And Local Taxes Tax Foundation

Don T Die In Nebraska How The County Inheritance Tax Works

Is Colorado A Community Property State Johnson Law Group

States With The Highest And Lowest Property Taxes Property Tax Tax States

Property Tax Comparison By State For Cross State Businesses

Thinking About Moving These States Have The Lowest Property Taxes

Property Taxes Property Tax Analysis Tax Foundation

Community Property States List Vs Common Law Taxes Definition

Property Taxes Property Tax Analysis Tax Foundation

Colorado Opportunity Zones Mile High Investment Opportunity Find Useful Data On Commercial Real Estate Pro In 2022 Commercial Real Estate Colorado Real Estate Sales

State Taxation As It Applies To 1031 Exchanges

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

State Tax Maps How Does Your State Rank Tax Foundation

Which States Are Community Property States In Divorce

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/community-property-states-3193432_color-fc6662865d234709b76fe67cce591897.png)